Coming Soon

Pre-Order Now

![[Pre-Order] Magic Pill: The Extraordinary Benefits and Disturbing Risks of the New Weight Loss Drugs [Official Release Date 2/05/2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781526670144_MPH_MagicPillTheExtraordinaryBenefitsandDisturbingRisksoftheNewWeightLossDrugs.jpg?v=1713230693&width=480)

![[Pre-Order] - National Geographic Kids Almanac 2025 (International Edition)[Official Release Date 7/05/2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781426376085_600x_ea734313-5be6-4459-a770-0a1b7a1915cb.png?v=1712883572&width=480)

![[Pre-Order] - Malaysian Taxation Principles and Practice (2024, 30th Edition) [Official Release Date 7/05/2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9789672289104_MPH_MalaysianTaxationPrinciplesandPractice_2024_30thEdition.jpg?v=1712538700&width=480)

ACCA 2024-25 [Pre-Order Now]

Expected Release Date: 15/5/2024

![FIA 2024-25 (ACCA F1) FBT Business & Technology: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514137.jpg?v=1711953198&width=480)

![FIA 2024-25 (ACCA F2) FMA Foundations in Management Accounting: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514175_MPH_FIA2024-25_ACCAF2_FMAFoundationsinManagementAccountingPractice_RevisionKit.png?v=1711942117&width=480)

![FIA 2024-25 (ACCA F2) FMA Foundations in Management Accounting: Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514144_MPH_FIA2024-25_ACCAF2_FMAFoundationsinManagementAccountingWorkbook.png?v=1711942637&width=480)

![FIA 2024-25 (ACCA F3) FFA Foundations of Financial Accounting: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514212__MPH_FIA2024-25_ACCAF3_FFAFoundationsofFinancialAccountingPractice_RevisionKit.png?v=1711943291&width=480)

![FIA 2024-25 (ACCA F3) FFA Foundations of Financial Accounting: Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514182_MPH_FIA2024-25_ACCAF3_FFAFoundationsofFinancialAccountingWorkbook.png?v=1711944404&width=480)

![ACCA 2024-25 F4 Corporate & Business Law (English): Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513413_MPH_ACCA2024-25F4Corporate_BusinessLaw_English_Practice_RevisionKit.png?v=1711944964&width=480)

![ACCA 2024-25 F4 Corporate & Business Law (Global): Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513451_MPH_ACCA2024-25F4Corporate_BusinessLaw_Global_Practice_RevisionKit.png?v=1711946773&width=480)

![FIA 2024-25 FA1 Recording Financial Transactions: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514823_MPH_FIA2024-25FA1RecordingFinancialTransactionsPractice_RevisionKit.png?v=1711947851&width=480)

School Revision

Explore our comprehensive collection of revision textbooks designed to enhance your learning experience.

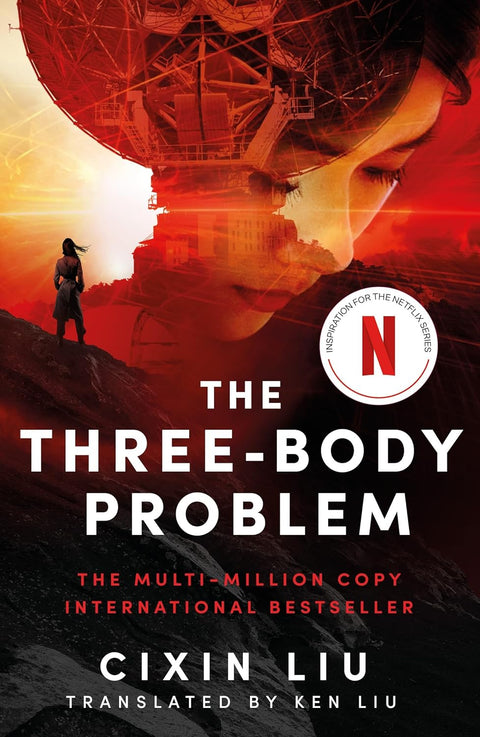

The Three-Body Problem: Now a major Netflix series (MTI)

Read the award-winning, critically acclaimed, multi-million-copy-selling science-fiction phenomenon - now a Netflix Original Series from the creators of Game of Thrones.

1967: Ye Wenjie witnesses Red Guards beat her father to death during China's Cultural Revolution. This singular event will shape not only the rest of her life but also the future of mankind.

Four decades later, Beijing police ask nanotech engineer Wang Miao to infiltrate a secretive cabal of scientists after a spate of inexplicable suicides. Wang's investigation will lead him to a mysterious online game and immerse him in a virtual world ruled by the intractable and unpredictable interaction of its three suns.

This is the Three-Body Problem and it is the key to everything: the key to the scientists' deaths, the key to a conspiracy that spans light-years and the key to the extinction-level threat humanity now faces.

Praise for The Three-Body Problem:

'Your next favourite sci-fi novel' Wired

'Immense' Barack Obama

'Unique' George R.R. Martin

'SF in the grand style' Guardian

'Mind-altering and immersive' Daily Mail

Winner of the Hugo and Galaxy Awards for Best Novel

About the Author

Ken Liu is the author of the epic fantasy series The Dandelion Dynasty, as well as short story collections The Paper Menagerie and Other Stories and The Hidden Girl and Other Stories. He has won the Hugo, Nebula, World Fantasy, and other top genre awards around the world for his fiction. A programmer and lawyer, he speaks and consults on futurism, technology history, and sustainable storytelling.

- Dimensions : 12.7 x 3 x 19.4 cm

![[Pre-Order] - Perempuan Busana Merah [Akan Ada Dipasaran 22/04/24] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9789674981761_MPH_PerempuanBusanaMerah.jpg?v=1712273715&width=480)

![King Of Sloth [Expected 30 April 2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/816WyIHYoKL._SL1500.jpg?v=1711503052&width=480)

![[Pre-Order] - If You Live To 100, You Might As Well Be Happy: Lessons for a Long and Joyful Life [Official Release Date 16/05/2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781846047794_MPH_IfYouLiveTo100_YouMightAsWellBeHappyLessonsforaLongandJoyfulLife_TheKoreanBestseller.jpg?v=1712038556&width=480)

![ACCA 2024 Advanced Taxation FA 2023: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513277_mph_ACCA2024AdvancedTaxationFA2023Practice_RevisionKit_fe0ee374-a9cb-4284-969b-25edb92ff60f.jpg?v=1712196736&width=480)

![ACCA 2024 Advanced Taxation FA 2023: Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513239.webp?v=1711953308&width=480)

![ACCA 2024 Taxation FA 2023: Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513208_MPH_ACCA2024TaxationFA2023Workbook.jpg?v=1711939257&width=480)

![FIA 2024 FTX Foundations in Taxation FA 2023: Interactive Text [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513307_MPH_FIA2024FTXFoundationsinTaxationFA2023InteractiveText.jpg?v=1711939651&width=480)

![FIA 2024 FTX Foundations in Taxation FA 2023: Practice & Revision Kit [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513291_MPH_FIA2024FTXFoundationsinTaxationFA2023Practice_RevisionKit.jpg?v=1711939942&width=480)

![ACCA 2024-25 F4 Corporate & Business Law (English): Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513383_MPH_ACCA2024-25F4Corporate_BusinessLaw_English_Workbook.png?v=1711945683&width=480)

![ACCA 2024-25 F4 Corporate & Business Law (Global): Workbook [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035513420_MPH_ACCA2024-25F4Corporate_BusinessLaw_Global_Workbook.png?v=1711947153&width=480)

![FIA 2024-25 FA1 Recording Financial Transactions: Interactive Text [Pre-Order] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781035514885_MPH_FIA2024-25FA1RecordingFinancialTransactionsInteractiveText.png?v=1711947516&width=480)

![Dog Man #12: The Scarlet Shedder (HC) [Embargo 19 March 2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/91q6YJUqiAL._SL1500.jpg?v=1704330980&width=480)

![Cat Kid Comic Club #5 : Influencers [Expected 28 November] - MPHOnline.com](http://mphonline.com/cdn/shop/files/81PLzqi-xhL._SL1500.jpg?v=1698021263&width=480)

![The Wealth Money Can't Buy: The 8 Hidden Habits to Live Your Richest Life (UK)[Official Release Date 9/04/2024] - MPHOnline.com](http://mphonline.com/cdn/shop/files/9781846048296_MPH_TheWealthMoneyCan_tBuyThe8HiddenHabitstoLiveYourRichestLife_UK_OfficialReleaseDate9042024.jpg?v=1710203262&width=480)